Applying Vector Databases in Finance for Risk and Fraud Analysis

Vector databases represent a transformative technology for the finance sector, particularly in risk analysis and fraud detection.

Read the entire series

- Image-based Trademark Similarity Search System: A Smarter Solution to IP Protection

- HM-ANN Efficient Billion-Point Nearest Neighbor Search on Heterogeneous Memory

- How to Make Your Wardrobe Sustainable with Vector Similarity Search

- Proximity Graph-based Approximate Nearest Neighbor Search

- How to Make Online Shopping More Intelligent with Image Similarity Search?

- An Intelligent Similarity Search System for Graphical Designers

- How to Best Fit Filtering into Vector Similarity Search?

- Building an Intelligent Video Deduplication System Powered by Vector Similarity Search

- Powering Semantic Similarity Search in Computer Vision with State of the Art Embeddings

- Supercharged Semantic Similarity Search in Production

- Accelerating Similarity Search on Really Big Data with Vector Indexing (Part II)

- Understanding Neural Network Embeddings

- Making Machine Learning More Accessible for Application Developers

- Building Interactive AI Chatbots with Vector Databases

- The 2024 Playbook: Top Use Cases for Vector Search

- Leveraging Vector Databases for Enhanced Competitive Intelligence

- Revolutionizing IoT Analytics and Device Data with Vector Databases

- Everything You Need to Know About Recommendation Systems and Using Them with Vector Database Technology

- Building Scalable AI with Vector Databases: A 2024 Strategy

- Enhancing App Functionality: Optimizing Search with Vector Databases

- Applying Vector Databases in Finance for Risk and Fraud Analysis

- Enhancing Customer Experience with Vector Databases: A Strategic Approach

- Transforming PDFs into Insights: Vectorizing and Ingesting with Zilliz Cloud Pipelines

- Safeguarding Data: Security and Privacy in Vector Database Systems

- Integrating Vector Databases with Existing IT Infrastructure

- Transforming Healthcare: The Role of Vector Databases in Patient Care

- Creating Personalized User Experiences through Vector Databases

- The Role of Vector Databases in Predictive Analytics

- Unlocking Content Discovery Potential with Vector Databases

- Leveraging Vector Databases for Next-Level E-Commerce Personalization

- Mastering Text Similarity Search with Vectors in Zilliz Cloud

- Enhancing Customer Experience with Vector Databases: A Strategic Approach

Introduction

Financial institutions deal with a deluge of heterogeneous data from various sources, including transaction records, market data, client information, and regulatory filings. This data is often unstructured or semi-structured, making it challenging to analyze and extract insights using traditional approaches.

Traditional methods involve the arduous task of transforming and mapping this intricate data into rigid, predefined schemas. This approach, while common, can be inflexible and lead to information loss. Complex analyses like fraud pattern detection, investment opportunity identification, or risk assessments often necessitate intricate modeling and computationally expensive operations. Furthermore, studies (Ding et al., 2015; Hu et al., 2018; Chen et al., 2019; Yang et al., 2018) have shown that non-traditional data sources, like news and social media, have been found to have profound influences on stock price movements. So how do you incorporate these new unstructured data types into your financial analysis?

Introducing Vector Databases for Financial Institutions

Vector databases and machine learning models present a compelling solution to these challenges by harnessing the power of vector embeddings and similarity search. These databases represent complex data points as high-dimensional vectors in a continuous vector space, where semantically similar data points are clustered together. This approach not only preserves the rich contextual information inherent in the data but also enables more effective analysis and pattern recognition, leading to valuable insights.

By integrating with machine learning models, vector databases can leverage advanced techniques like approximate nearest neighbor search, clustering algorithms, and neural network-based embeddings to efficiently identify similar data points, detect anomalies, and surface insights that would be difficult to uncover using traditional methods. For instance, they can quickly pinpoint transactions that exhibit patterns akin to known fraud cases identified by machine learning models or identify investment opportunities based on similarities with historical market trends.

Furthermore, vector databases are designed to handle massive volumes of data and support distributed architectures, ensuring scalability and performance even as data volumes grow exponentially. Seamlessly integrating with machine learning and natural language processing models, they enable advanced analytics and decision-making capabilities.

Institutions can leverage this powerful combination to build financial intelligence platforms, real-time fraud detection systems, personalized investment recommendation engines, and advanced risk management solutions. This integrated approach empowers financial institutions to gain a competitive edge, mitigate risks, and drive innovation in an increasingly data-driven industry by unlocking the full potential of their complex data.

Vector Databases Explained

Before we dive into Vector Databases, let's quickly understand Vector Embeddings. Vector Embeddings encode complex patterns and semantic relationships within high-dimensional vector spaces. Think of it like a map, where similar objects are located closer together, and dissimilar objects are farther apart.

Vector Embeddings are created by machine learning models that analyze and learn from large amounts of data. When you take a look at an embedding, you will see that it is an array of numbers that computers can work with. These numbers are carefully determined by the model to ensure that embeddings of similar data points are positioned close together on the "map," while dissimilar data points are positioned farther away.

Vector embeddings can be stored in any database with a vector search library from which users can look for semantically similar items. However, since financial data analysis is done on massive datasets, a purpose-built vector database is advised to efficiently handle the scale in a performant manner.

Case Studies and Real-world Applications

One of the typical use cases in Finance with vector search is being able to pour through the massive amounts of financial documents to find similar or anomalous items depending on your use case. For example, SEC filings contain a lot of detailed financial information about publicly traded companies. Using a Large Language Model (LLM) is helpful because it can help summarize the data for easier consumption. But if you just ask an LLM to do this, it likely doesn’t have the latest SEC filing and you may end up with an inaccurate answer known as an AI hallucination.

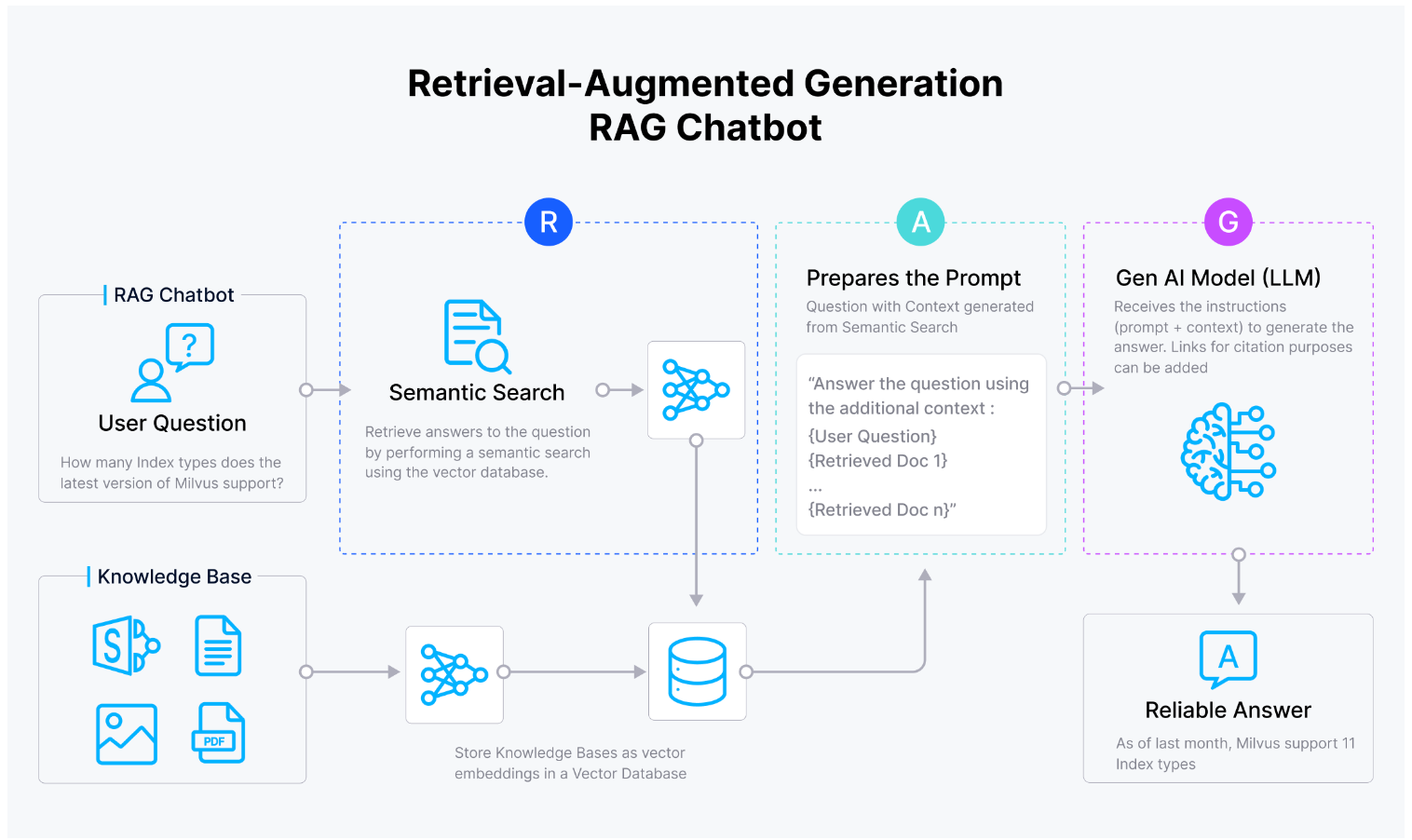

To combat this, we can create a chatbot interface for our users to interface with instead of using the LLM directly. We then create the vector embeddings of our content and store it in the vector database. When the user prompts (asks) our chatbot a question, we will instruct the LLM to retrieve the information that is relevant to what the query was from the vector database to ensure an accurate answer. It will convert the question into a vector embedding and do a semantic similarity search using the data stored in the vector database. Once armed with the Retrieval-Augmented answer, our Chatbot app can send this and the sources to the LLM and ask it to generate a summary with the user questions, the data provided, and evidence that it did as instructed.

Retrieval Augmented Generation (RAG)

Retrieval Augmented Generation (RAG)

Retrieval Augmented Generation with Troop

Troop has built a proxy advisory platform for asset stewardship teams to help them streamline their research efforts used to advocate for their clients' values and goals. They do this by combing through the SEC’s dense archives to make that vast unstructured dataset accessible. With the use of Retrieval Augmented Generation (RAG) framework held up with ML models, an LLM and the Milvus vector database, they are able to parse and extract from proxy filings the essential information required for organizing and evaluating governance questions more efficiently.

Identifying Market Opportunities with OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers originating and managing a diversified portfolio of high-quality investments in bonds, public and private credit, public and private equity, infrastructure and real estate. Omers' Data Science/Data Engineering team is utilizing Milvus to create a semantic search solution for financial documents, harnessing Milvus' vector database capabilities to efficiently index and query complex financial data for improved insight and retrieval.

Fraud Detection with Zigram

Zigram is a Global Risk Screening Solution that helps organizations identify and manage third-party anti-money laundering, financial crime, emerging and other business risks. Zigram employs Milvus for fraud detection by comparing real-time transactions against a database of known fraudulent activities, utilizing vector search technology to quickly and accurately identify potential fraud, enhancing security and trust in their operation.

Integrating Vector Databases into Financial Systems

You need to consider several factors when integrating vector databases into your financial architecture:

- Explore the compatibility of your existing systems with vector databases and tackle any interoperability hurdles for a seamless integration experience.

- Data security is paramount. Look for Vector Database solutions that incorporate a multi-layered approach to safeguarding data integrity and privacy. Look for data encryption at rest and in transit, proper RBAC support, and compliance with SOC 2 Type II, ISO 27001, and GDPR to confidently safeguard sensitive financial data.

- Through engaging training sessions, empower your team with the know-how of vector databases and their potential in risk analysis, fraud detection, and beyond.

- Stay vigilant and address potential biases and limitations inherent in the data and the similarity search process.

Future Trends in Finance and Vector Search

So many exciting things are happening in AI, and hopefully you can start to see that this really is just the beginning when it comes to beginning the full power of AI to the Finance world. Here are a few interesting papers and notebooks that could show us the things to come!

Stock2VEC

Traditional predictive models rely on historical data from companies within the same industry to make predictions. However, this approach may not be sufficient for large, complex companies operating across multiple industries or innovative companies without established peers. Considering only industry-specific data can lead to inaccurate predictions. Companies share similarities in dimensions beyond industry, such as geographic location and size. This raises the question of whether cross-company information from various dimensions should be incorporated to enhance predictive models.

In this paper, the authors introduce Stock2Vec, an inexpensive but efficient embedding of company stocks to learn cross-company inference.

Stock Embeddings Acquired from News Articles

In another paper, the authors suggest that news articles influence the dynamics of financial markets. For example, after breaking news releases, the share prices of related stocks are often observed to move. This suggests using natural language processing (NLP) to aid traders by analyzing this influence between news article texts and prices.

Conclusion

Vector databases represent a transformative technology for the finance sector. By enabling the efficient storage, management, and querying of high-dimensional financial data, building sophisticated predictive models that can anticipate market movements with uncanny accuracy, or automating complex decision-making processes that would once require hours of manual analysis will become a reality.

- Introduction

- Introducing Vector Databases for Financial Institutions

- Vector Databases Explained

- Case Studies and Real-world Applications

- Integrating Vector Databases into Financial Systems

- Future Trends in Finance and Vector Search

Content

Start Free, Scale Easily

Try the fully-managed vector database built for your GenAI applications.

Try Zilliz Cloud for FreeKeep Reading

Building Scalable AI with Vector Databases: A 2024 Strategy

Vector databases are pivotal for scalable AI applications in today's digital landscape.

Transforming PDFs into Insights: Vectorizing and Ingesting with Zilliz Cloud Pipelines

You will learn how Zilliz Cloud Pipeline transforms PDF data into a format ready for LLMs to use in semantic search tasks. Finally, we will conduct data retrieval using vector search.

The Role of Vector Databases in Predictive Analytics

Explore how vector databases enhance Predictive Models and their applications.